Portfolio Documents We Manage

We handle and organize all your financial and tax documents with care, accuracy, and confidentiality. Our goal is to keep your records clear, complete, and ready for bookkeeping, payroll, and tax filing at any time. If you want to check quality and sample of our previous work we attach it section wise.

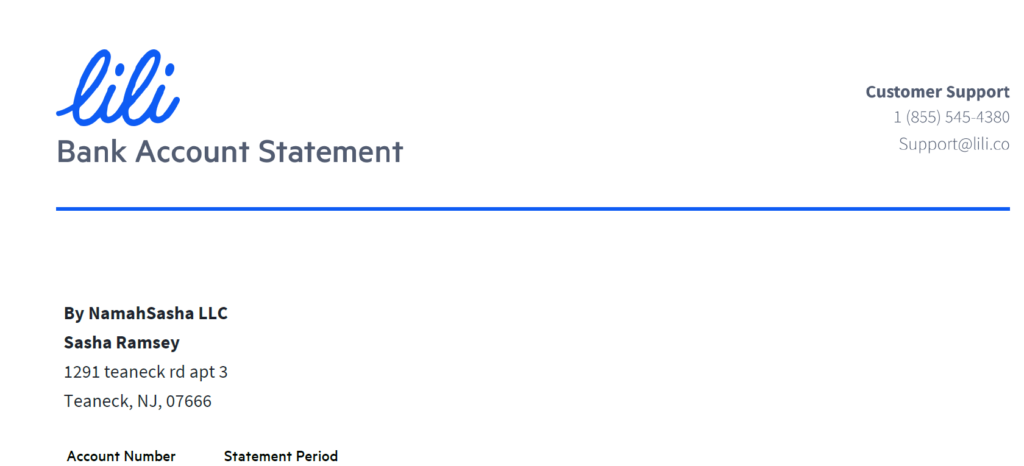

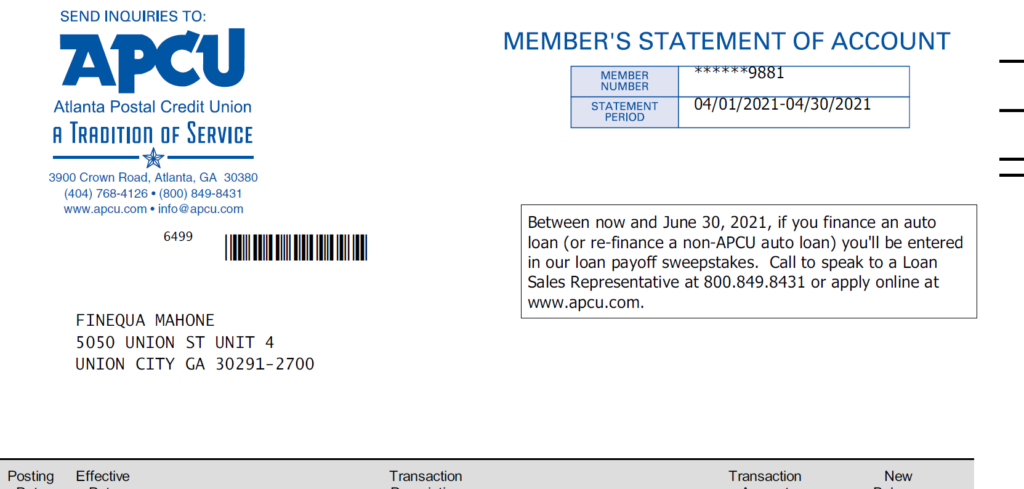

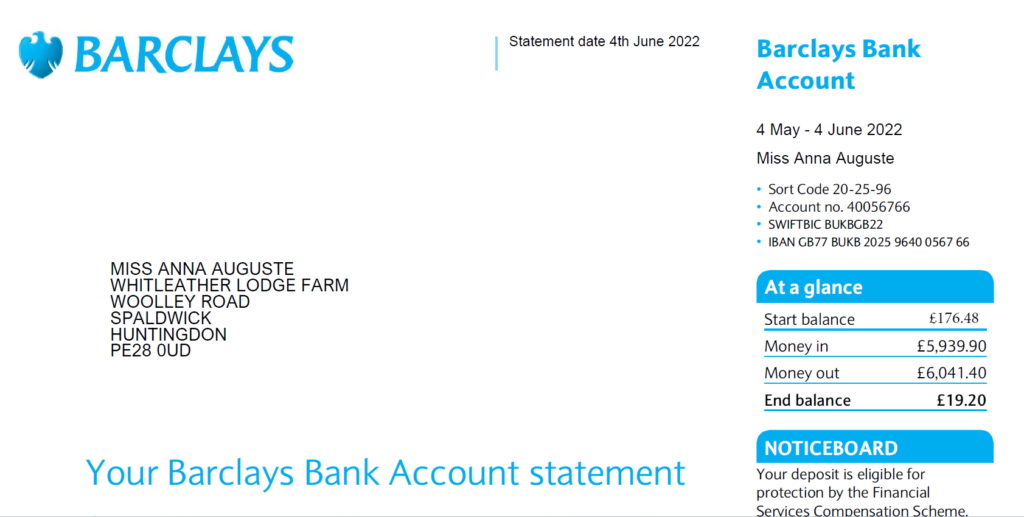

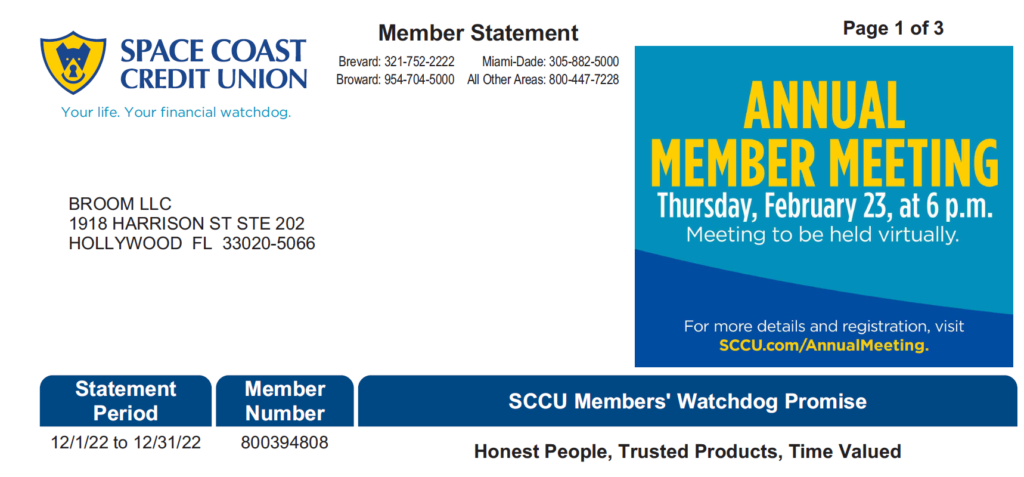

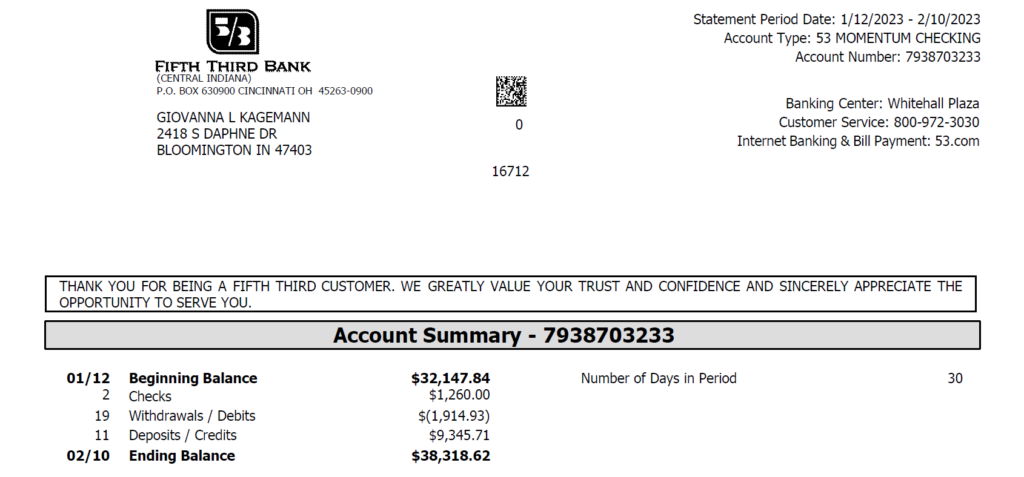

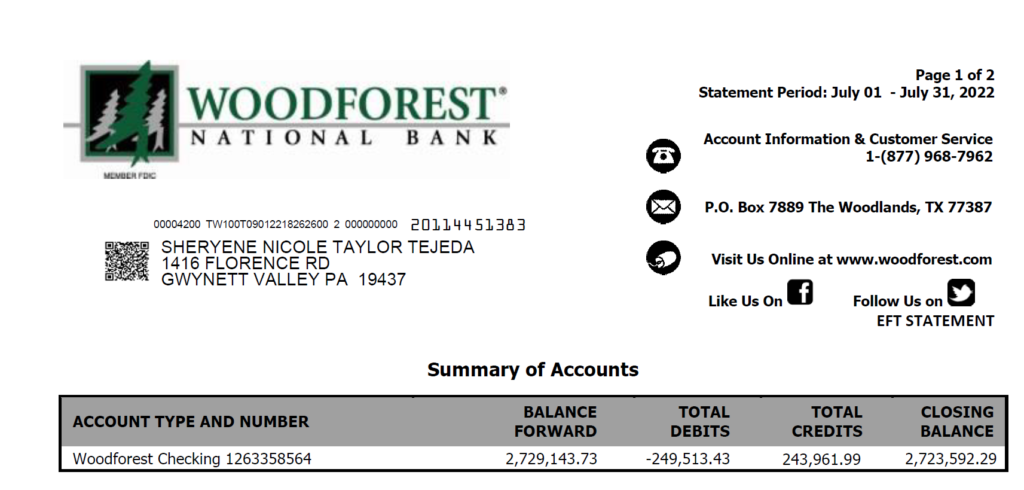

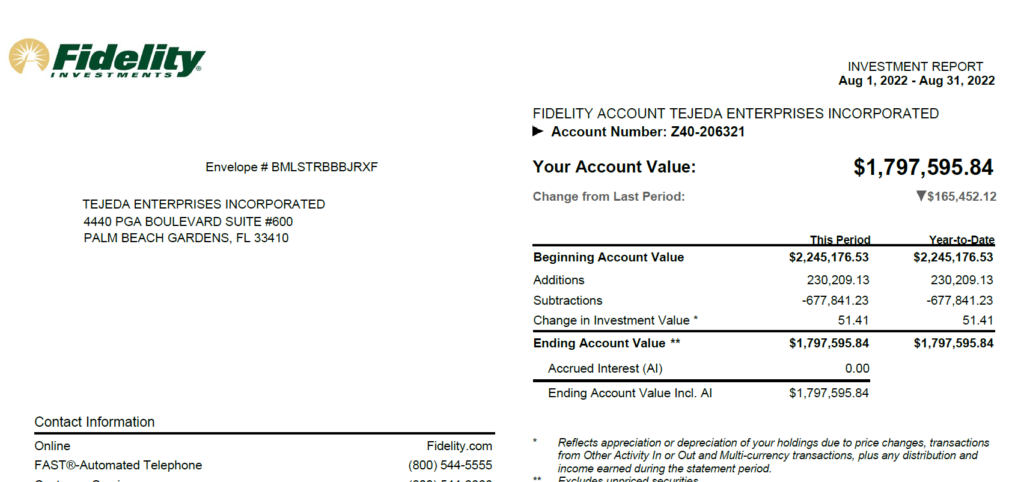

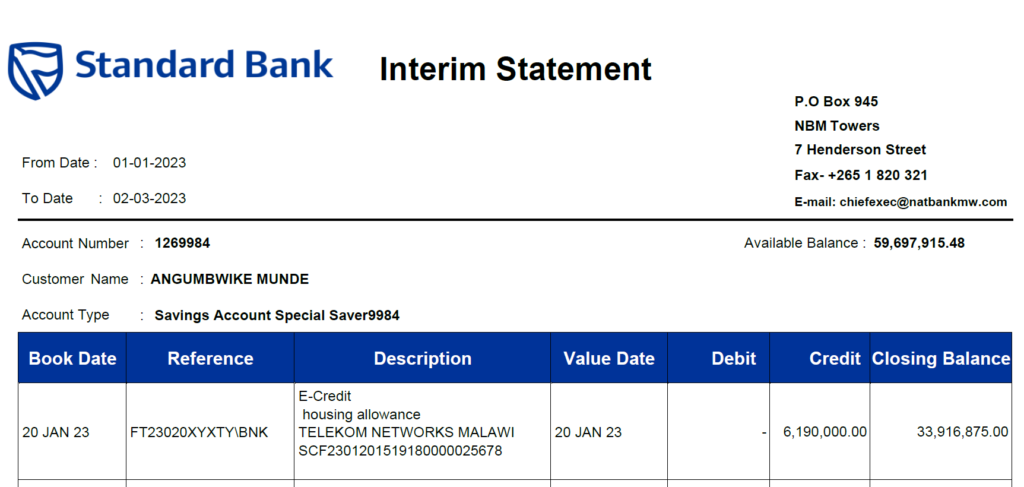

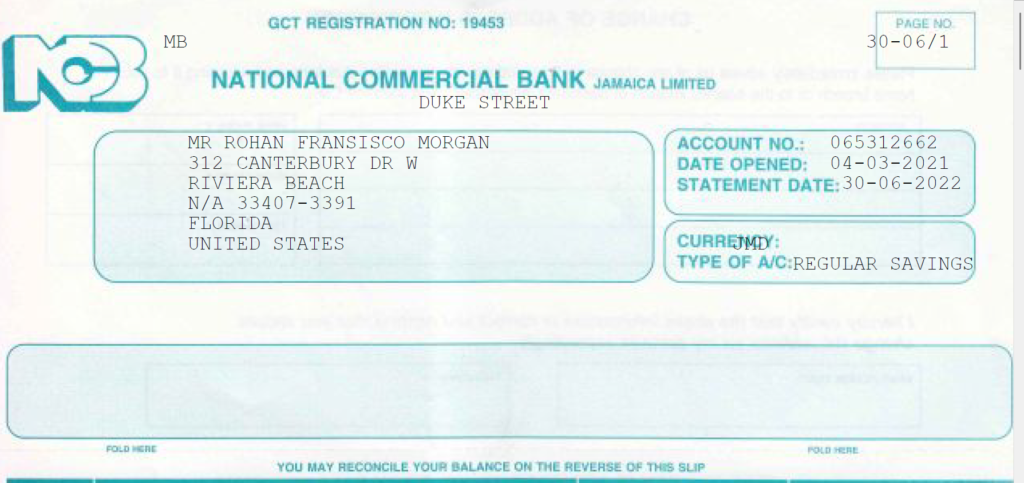

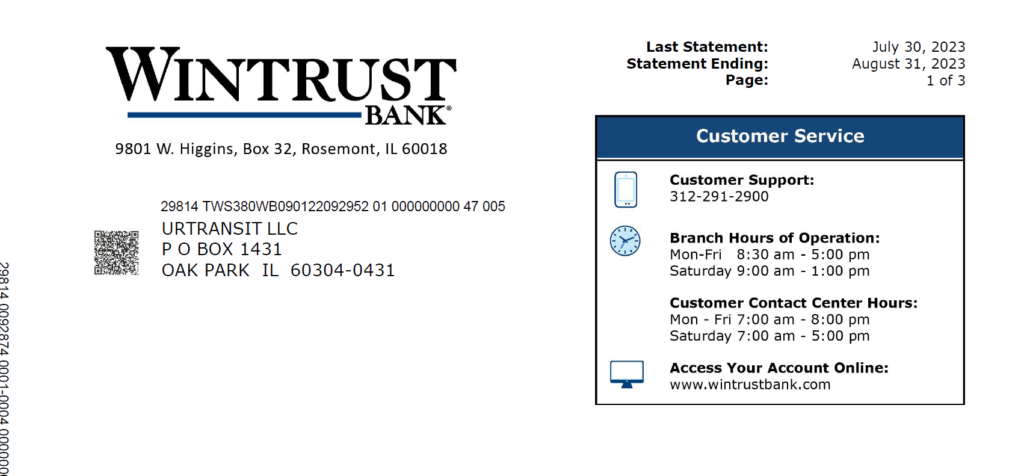

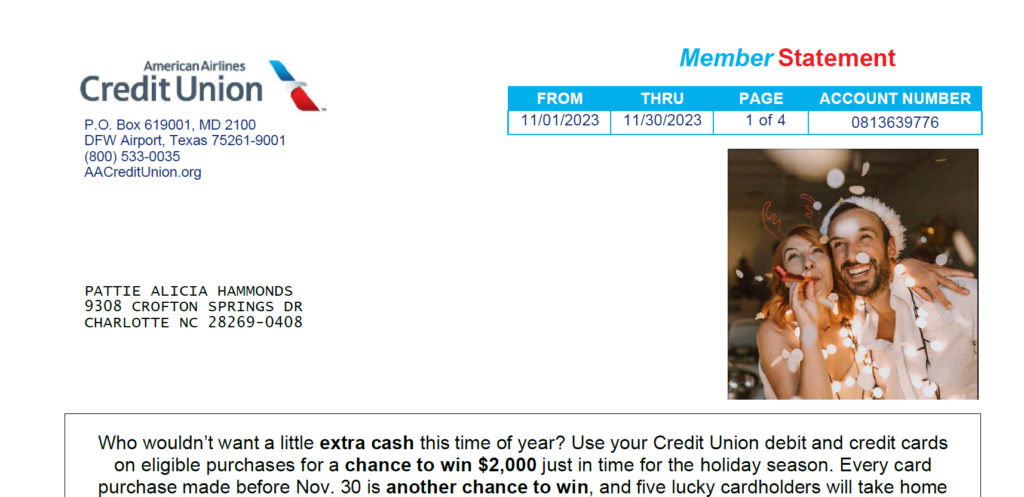

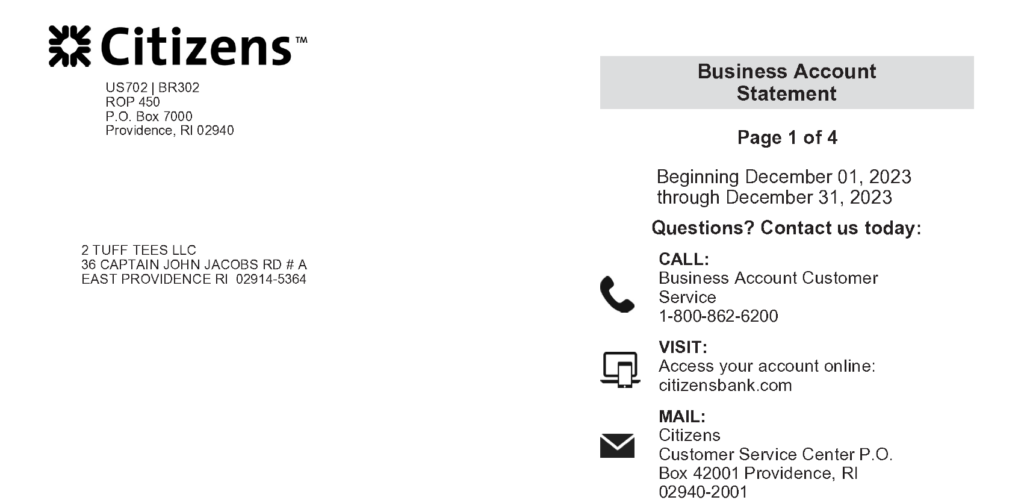

Bank Statements

We collect, review, and organize your bank statements to ensure all transactions are properly recorded. This helps with accurate bookkeeping, cash flow tracking, and tax preparation. Clean bank records reduce errors and save time during audits or year-end filing.

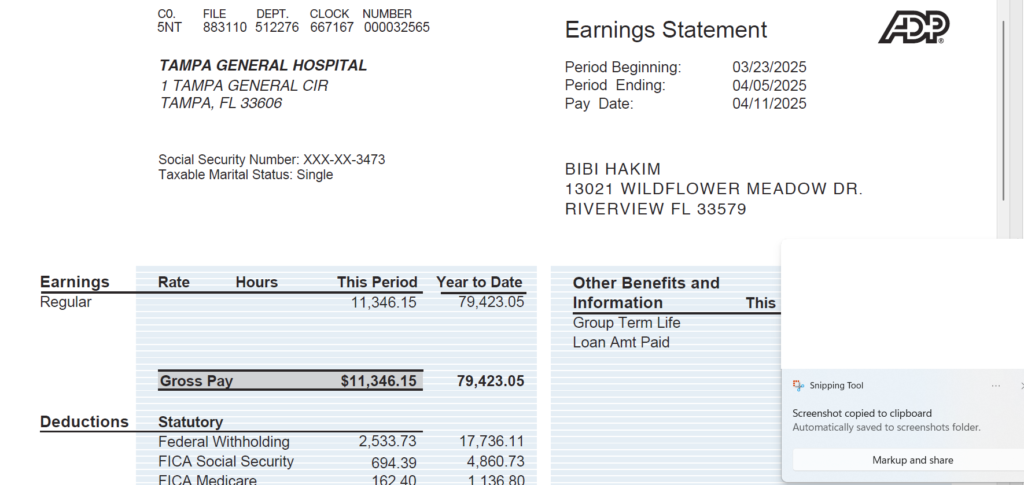

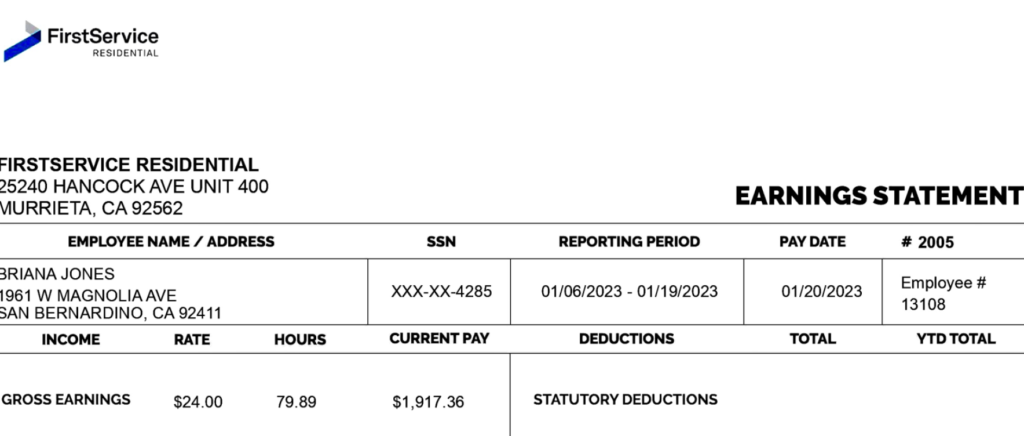

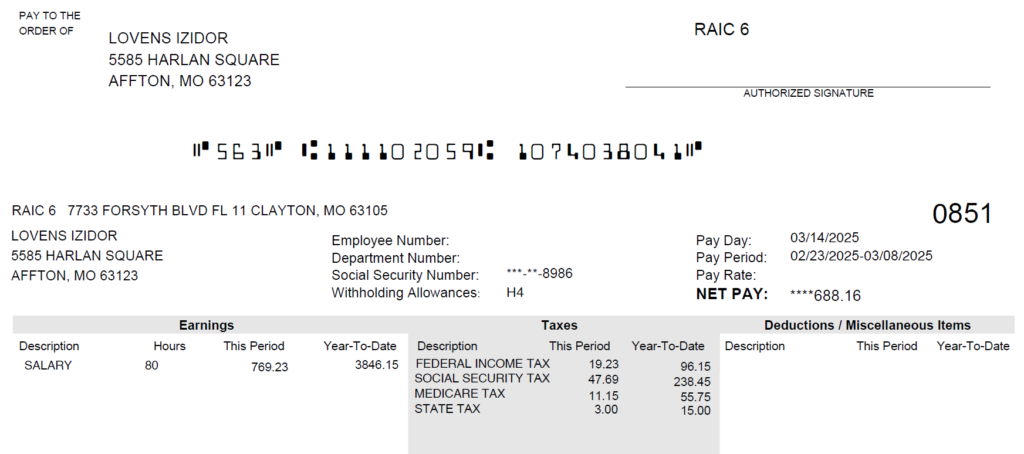

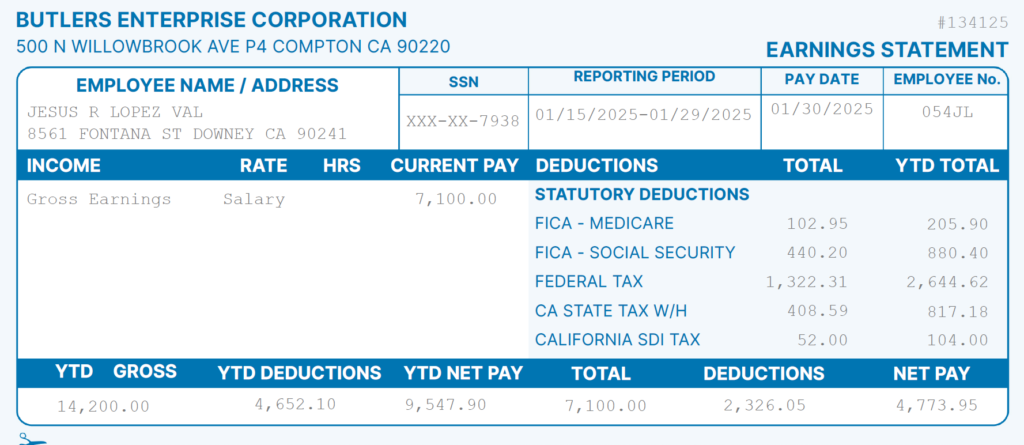

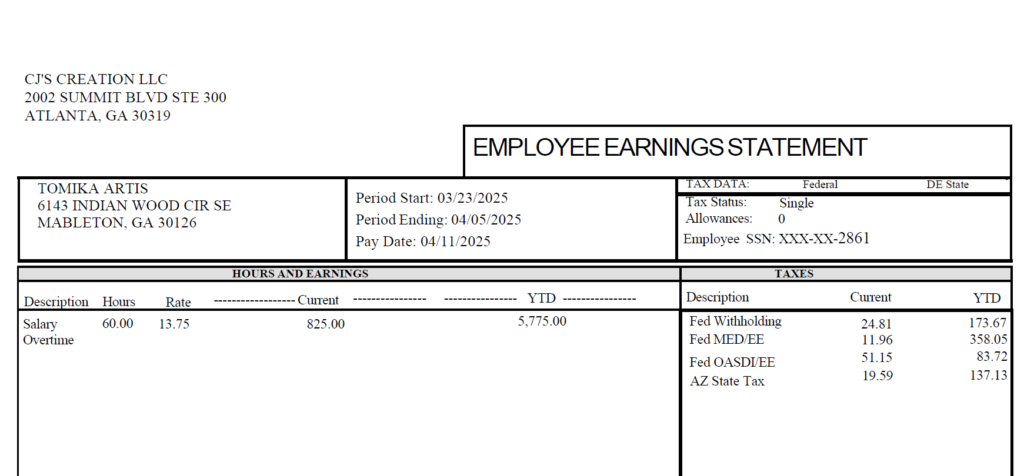

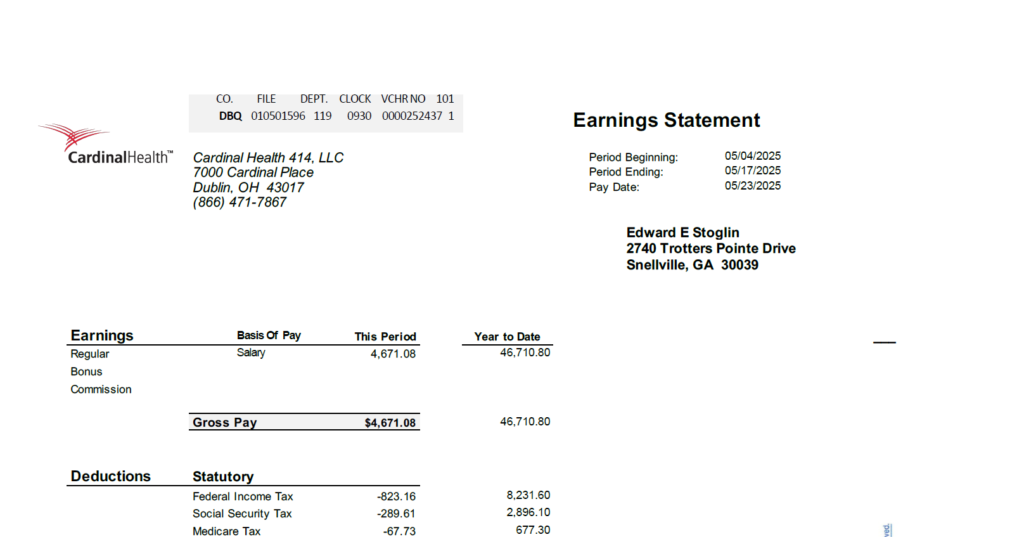

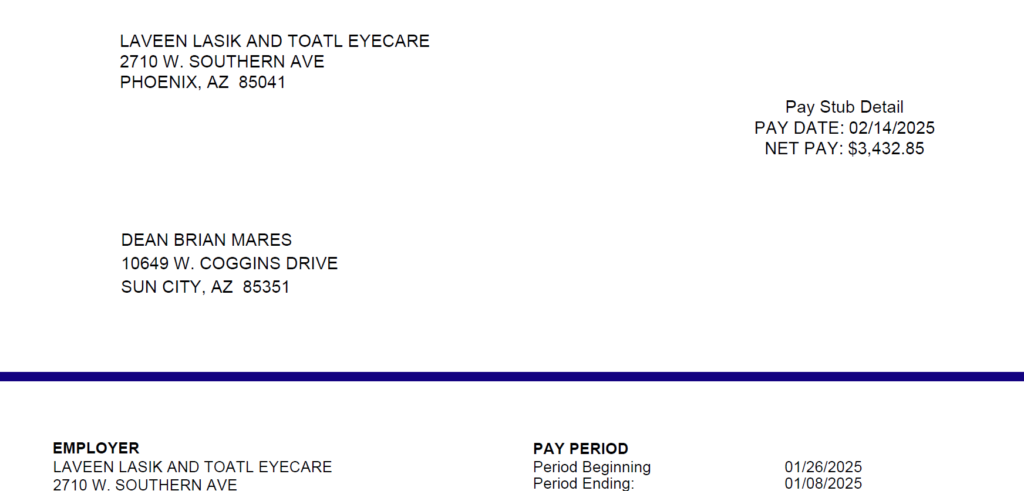

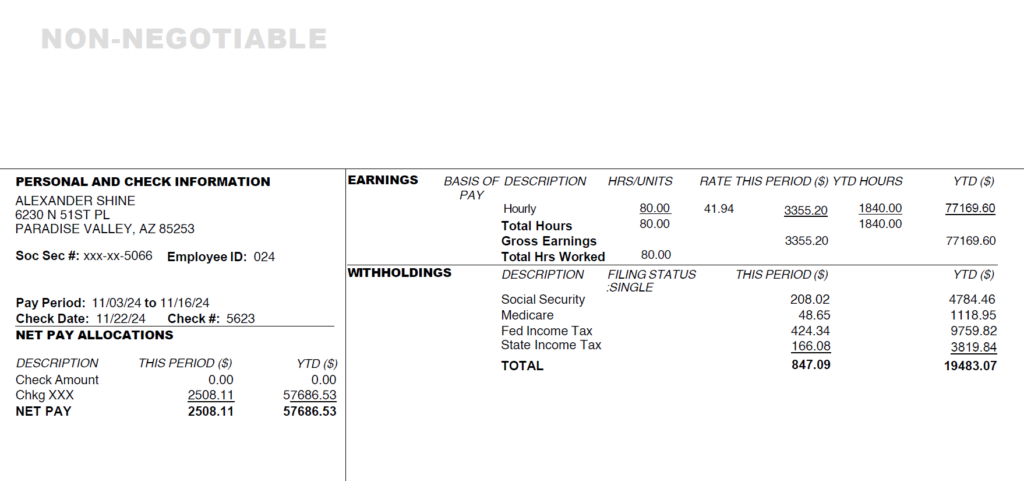

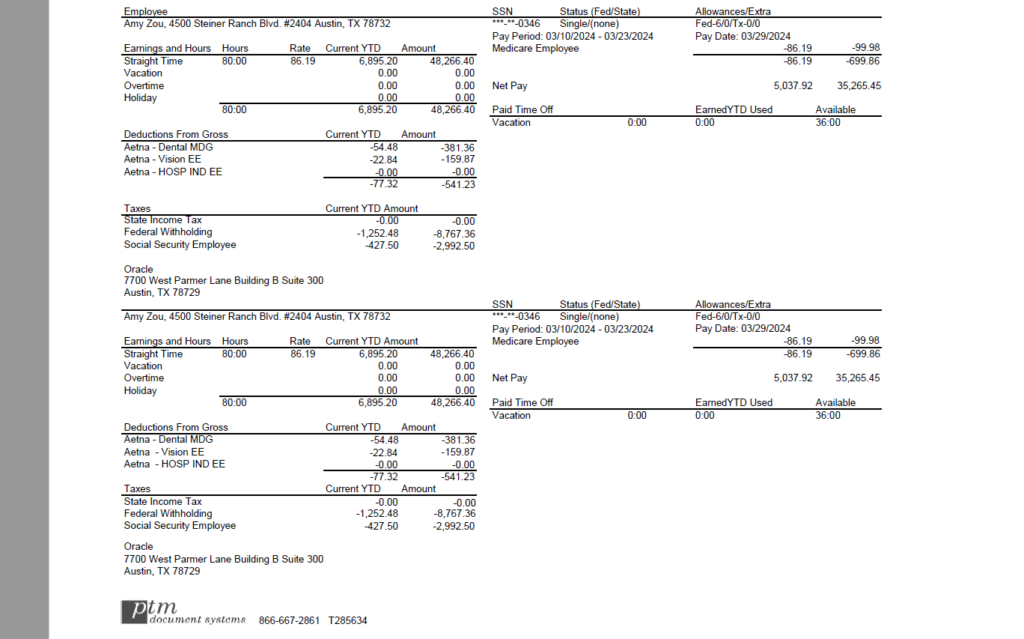

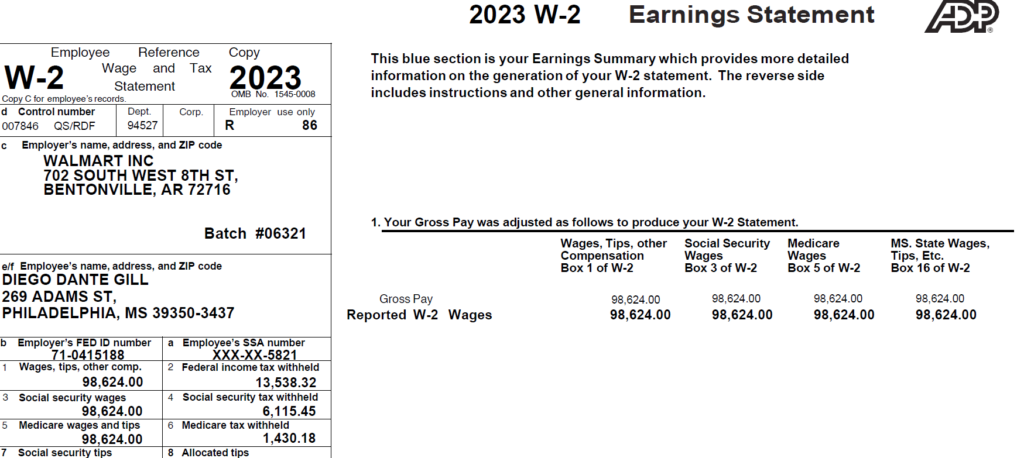

Paystubs

We manage employee and personal paystubs to keep payroll records accurate and compliant. Our team ensures wages, deductions, and taxes are correctly documented, making payroll processing and tax reporting smooth and stress-free.

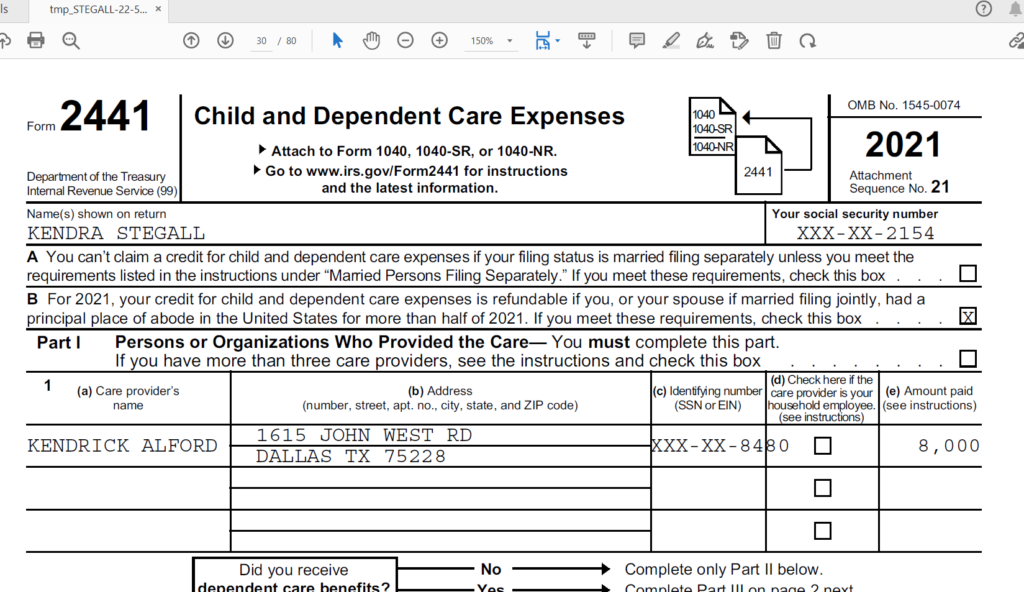

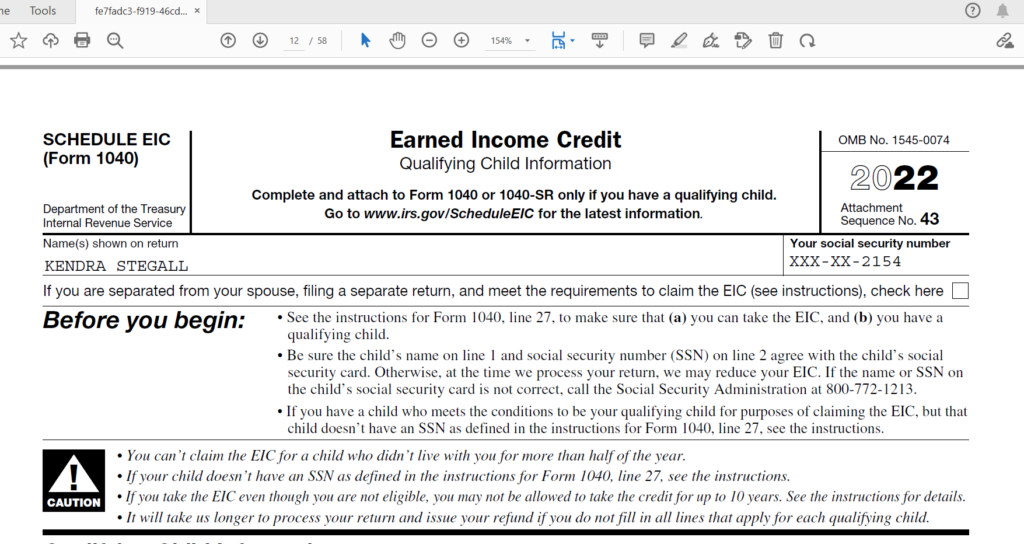

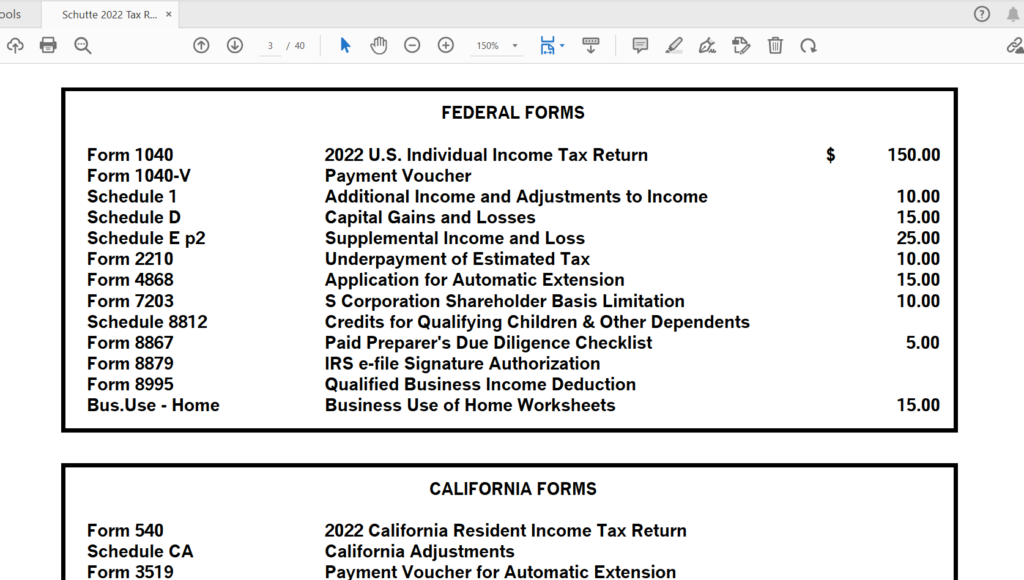

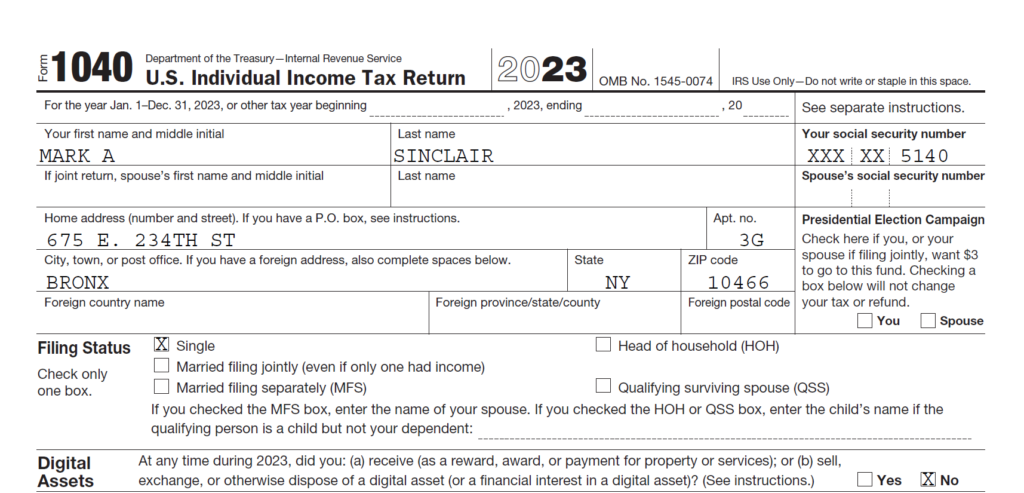

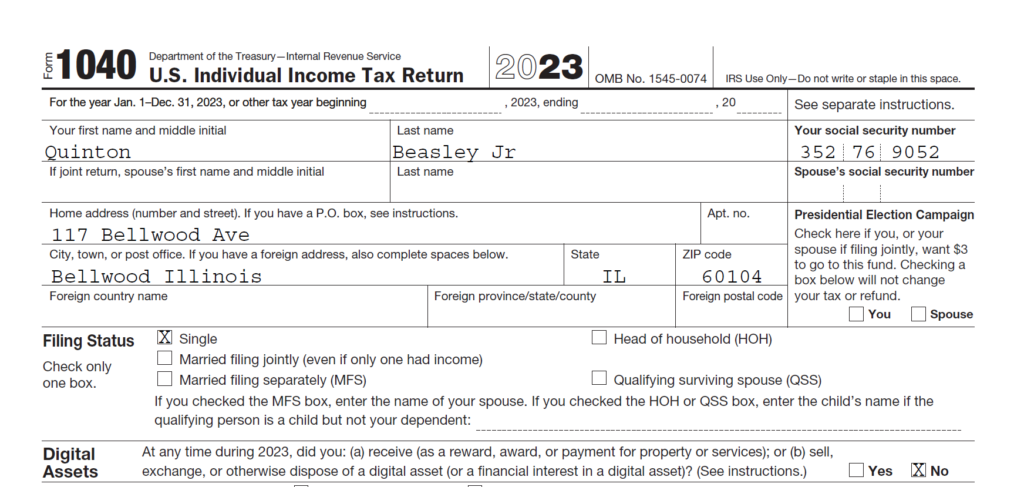

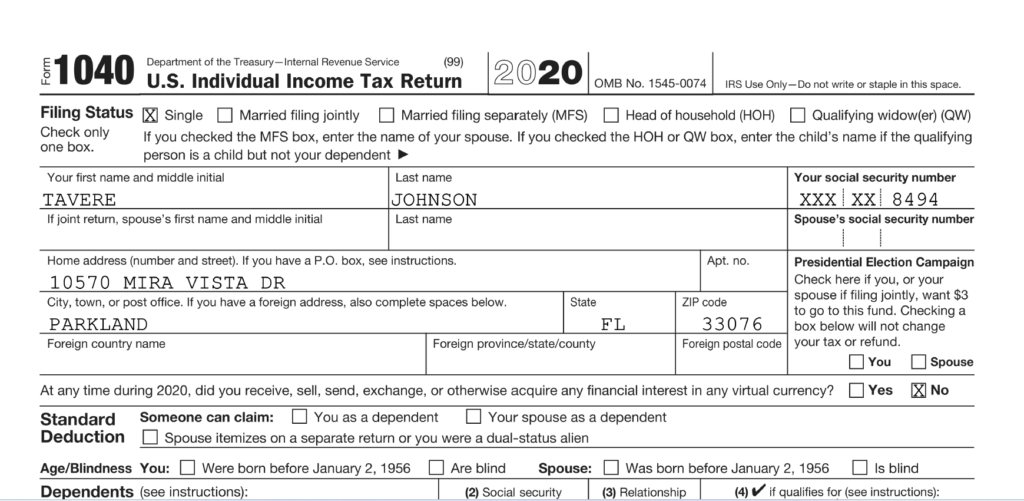

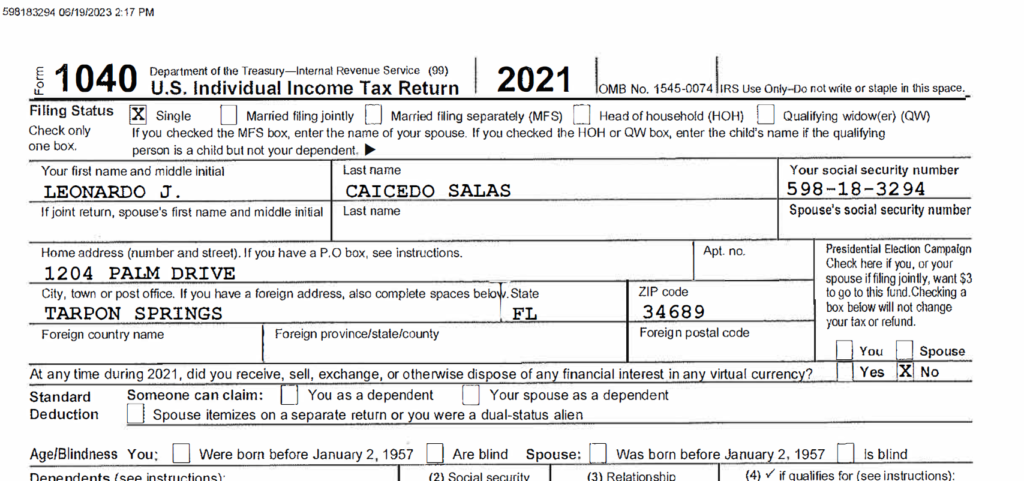

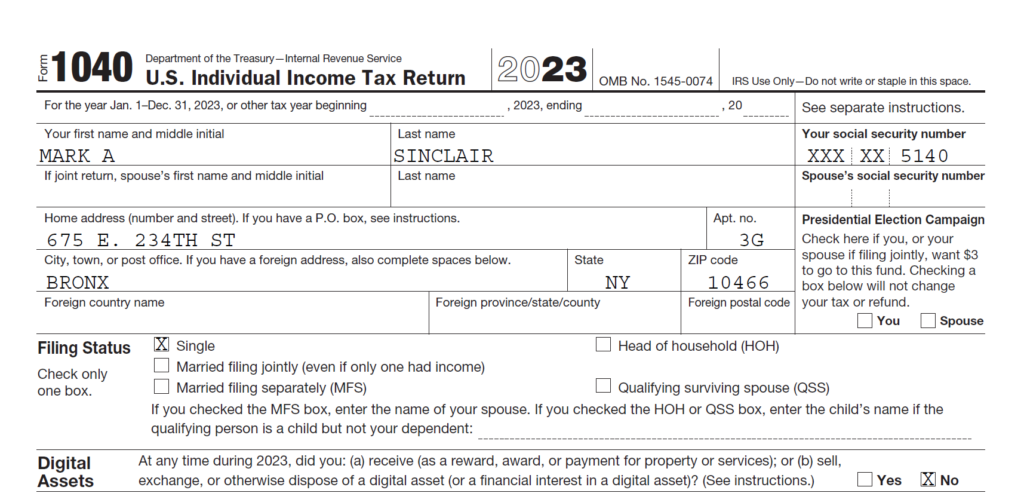

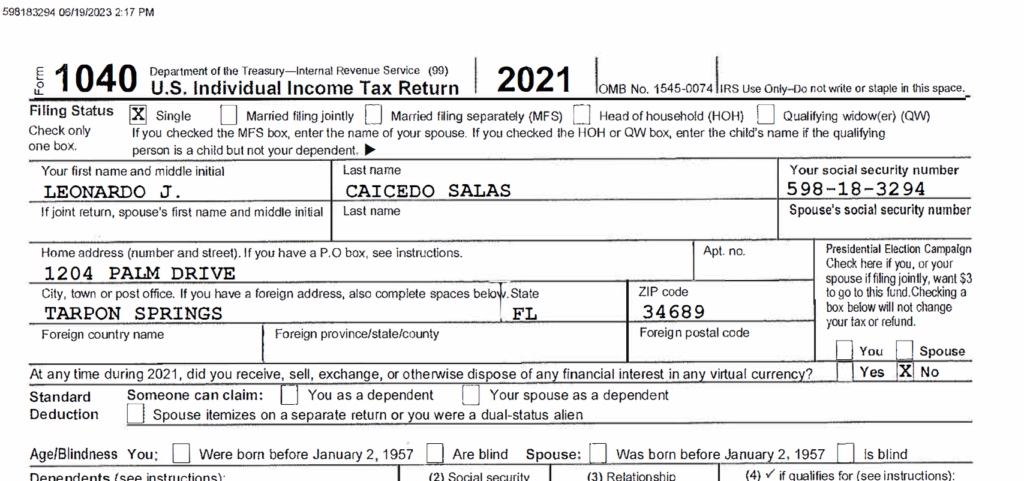

Personal Taxes

We handle all personal tax documents to help you file correctly and on time. Our experts review income, deductions, and credits to reduce tax liability and avoid costly mistakes. Your personal tax records stay organized and secure throughout the year.

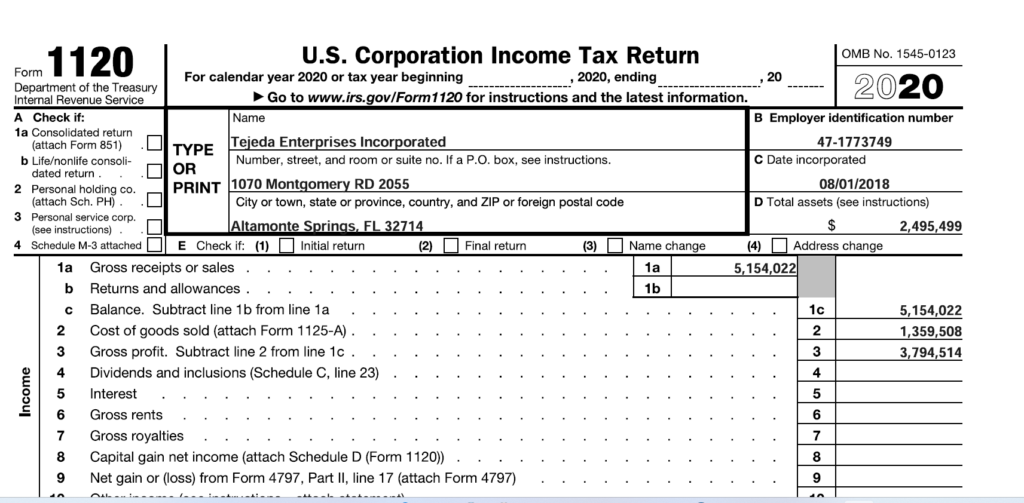

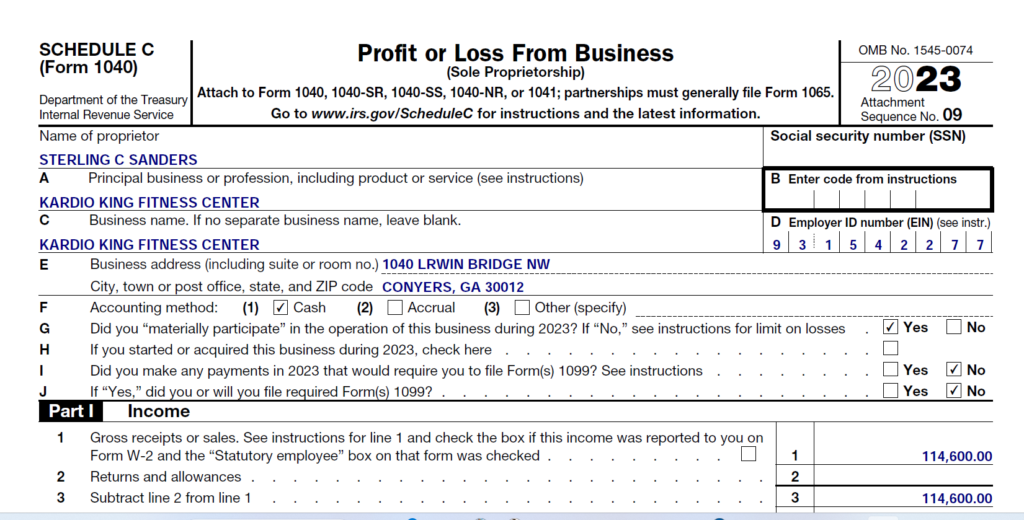

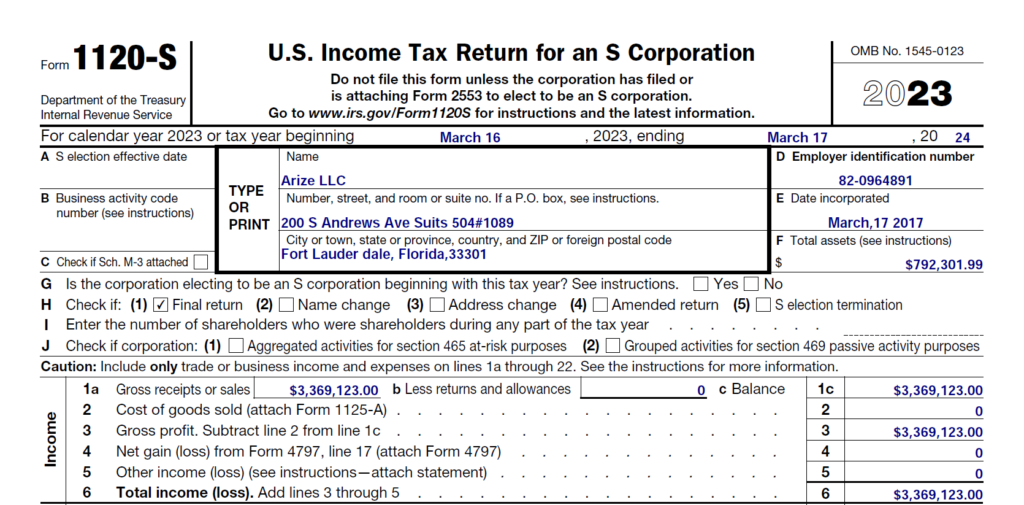

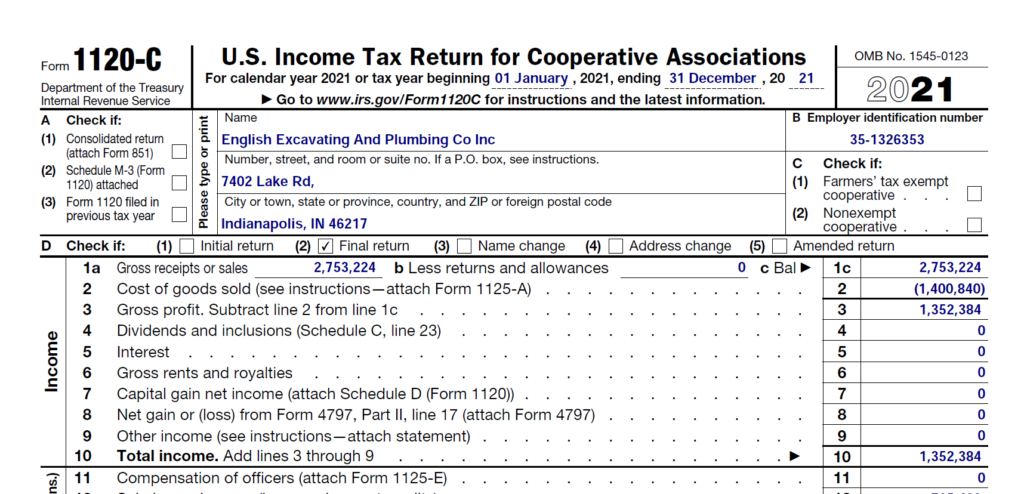

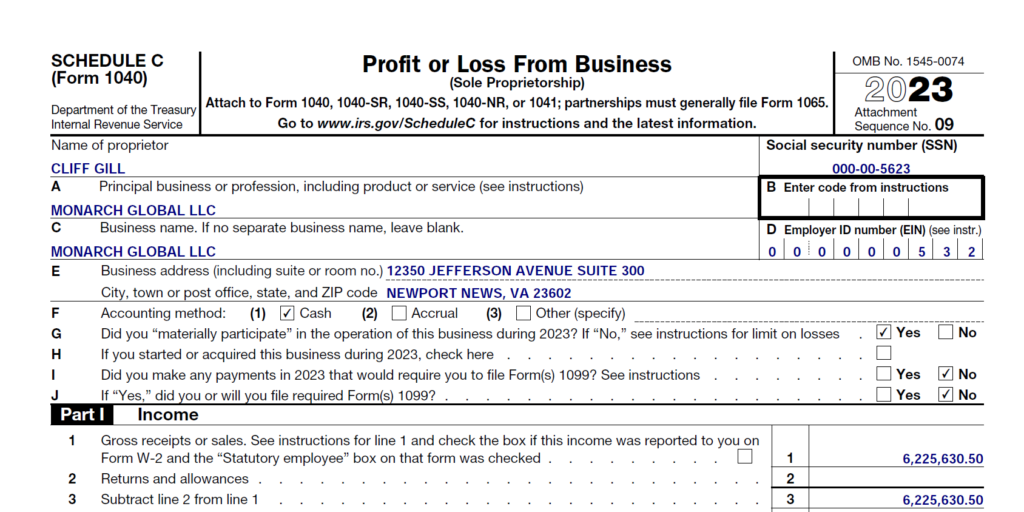

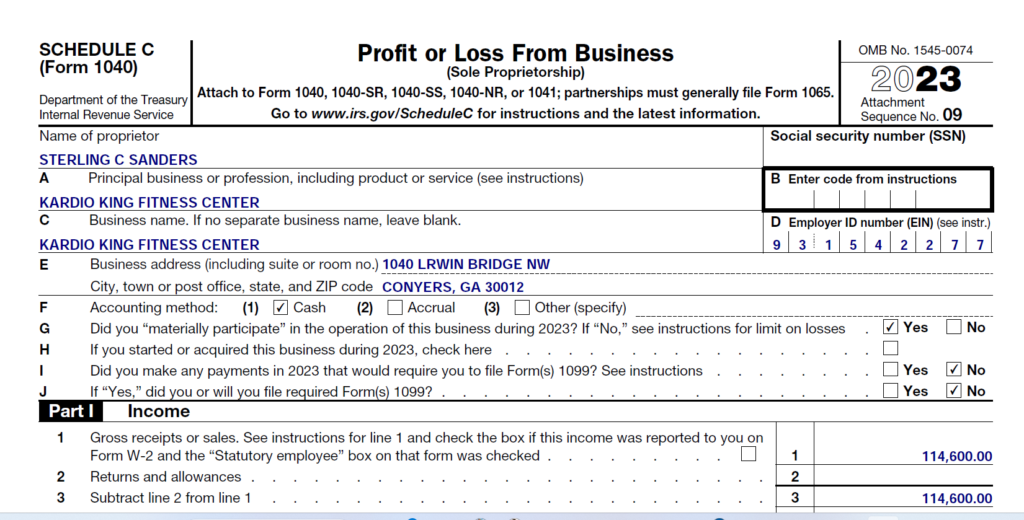

Business Taxes

We manage business tax documents for all types of businesses, including sole proprietors, LLCs, and corporations. From income reports to expense tracking, we prepare everything needed for accurate filing and full compliance with tax regulations.

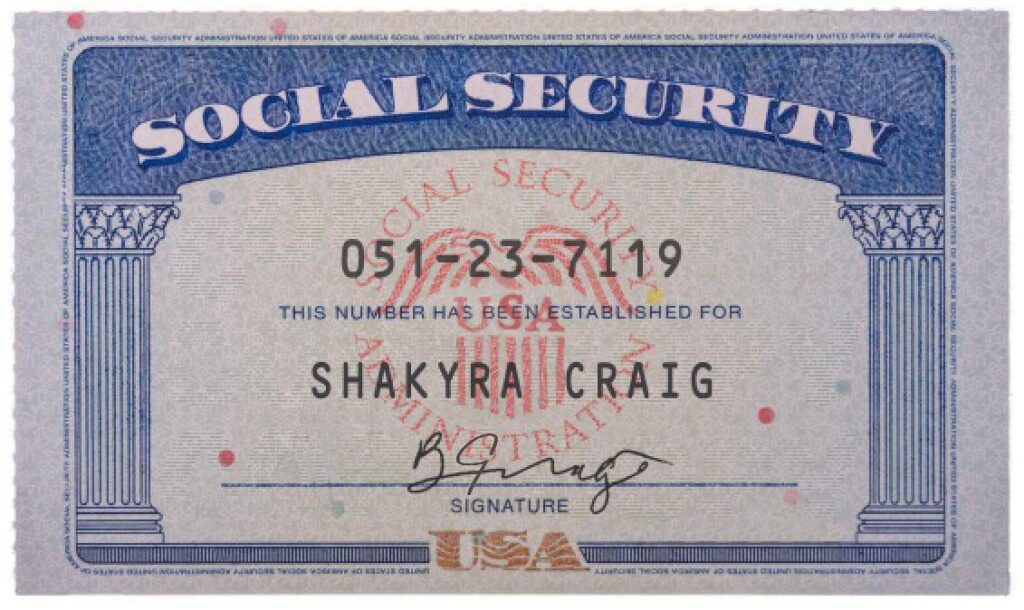

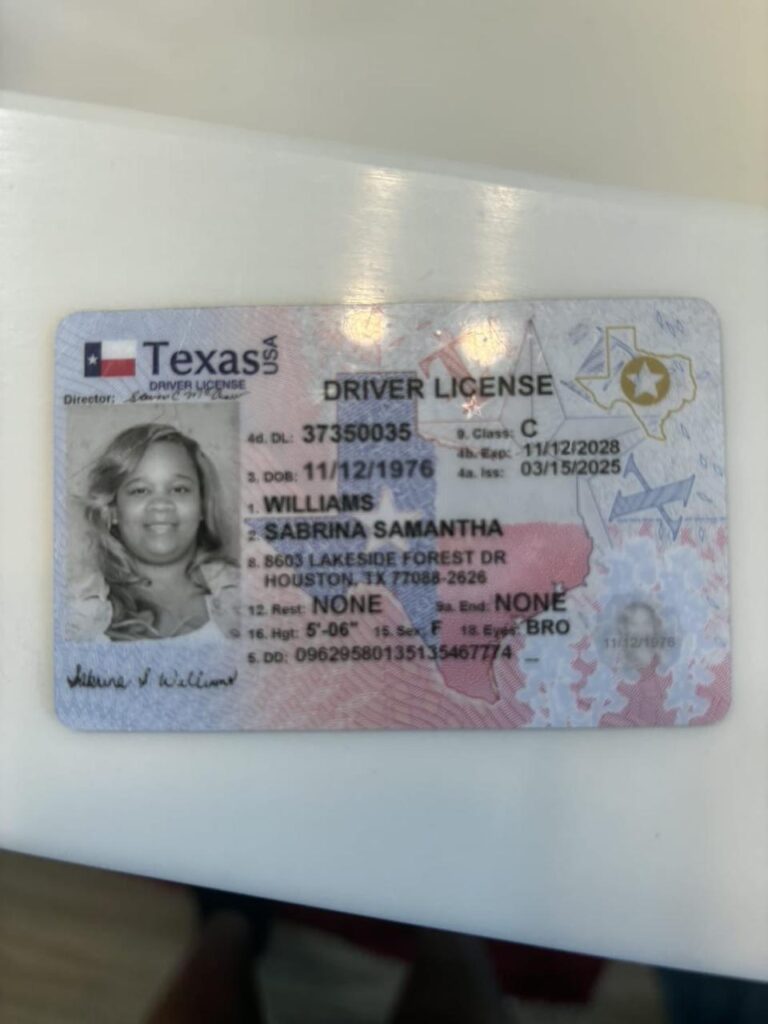

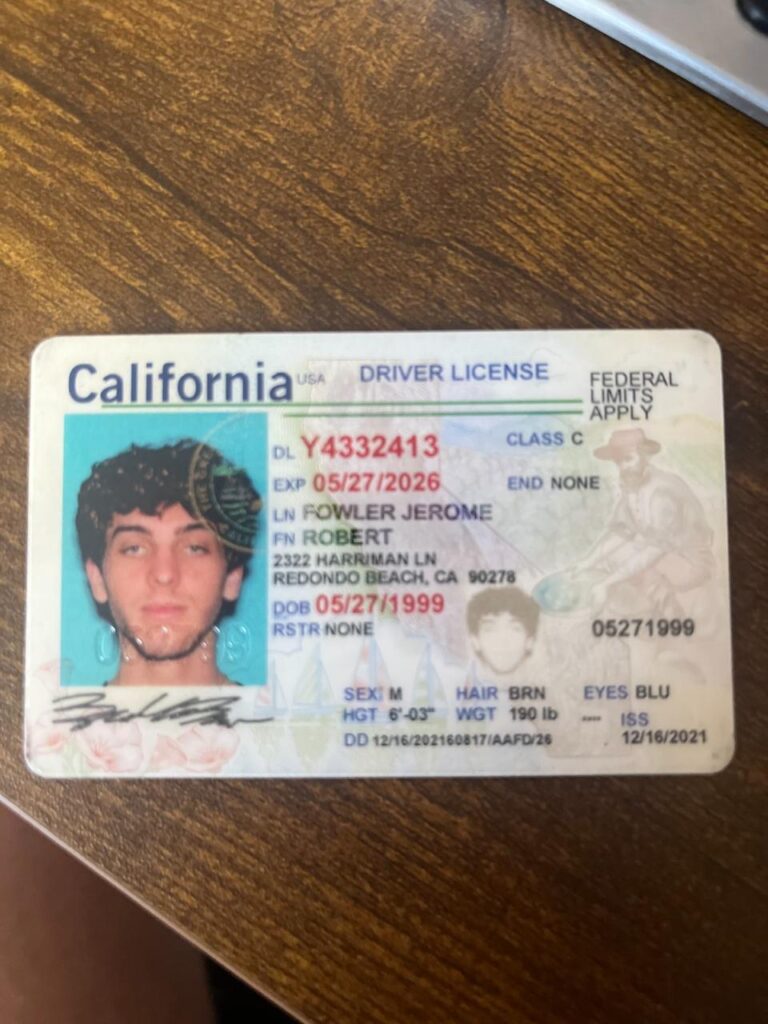

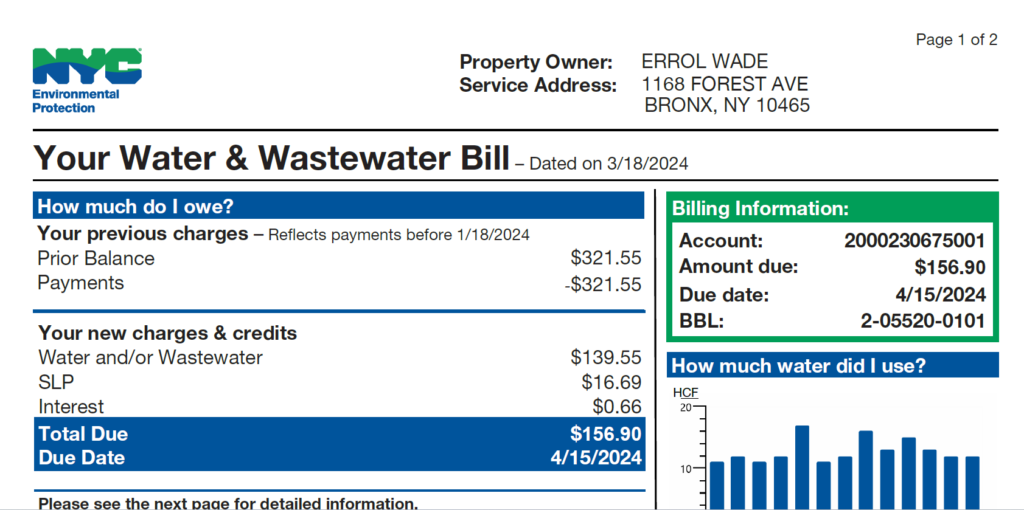

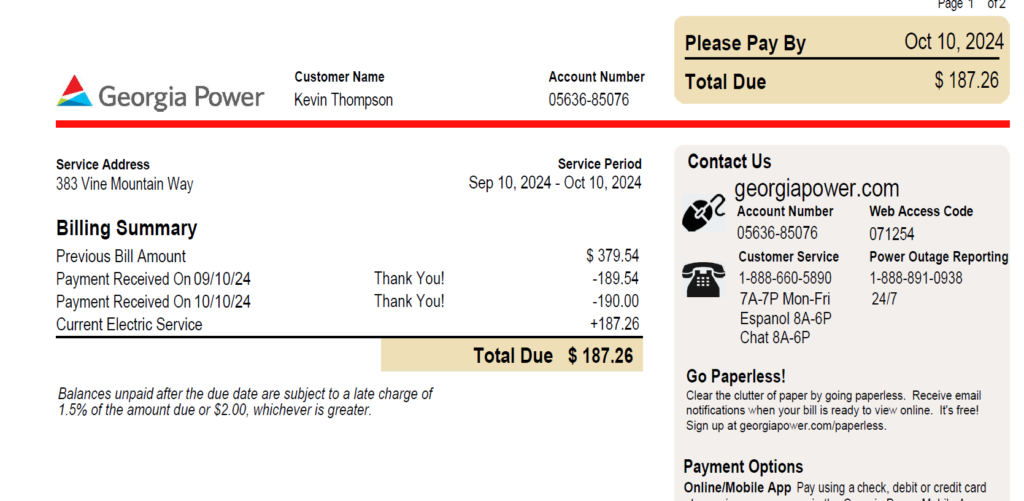

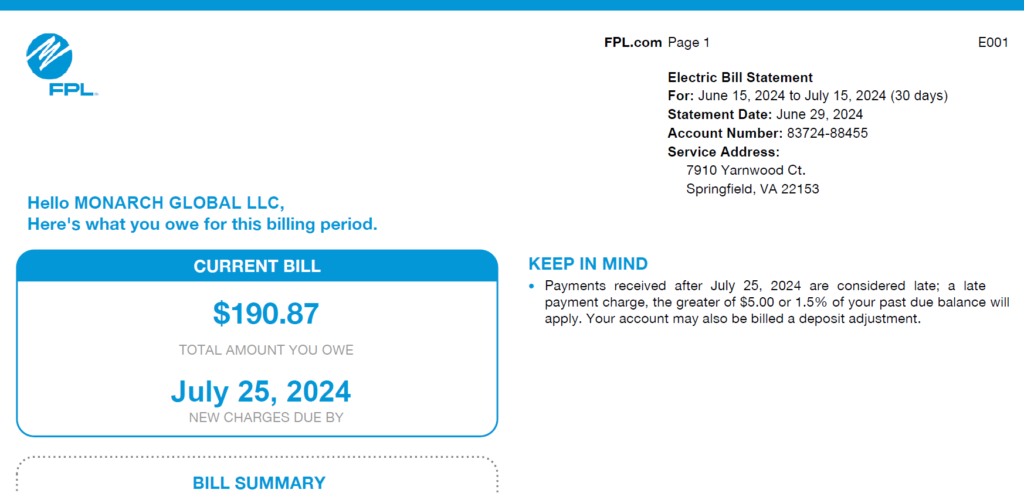

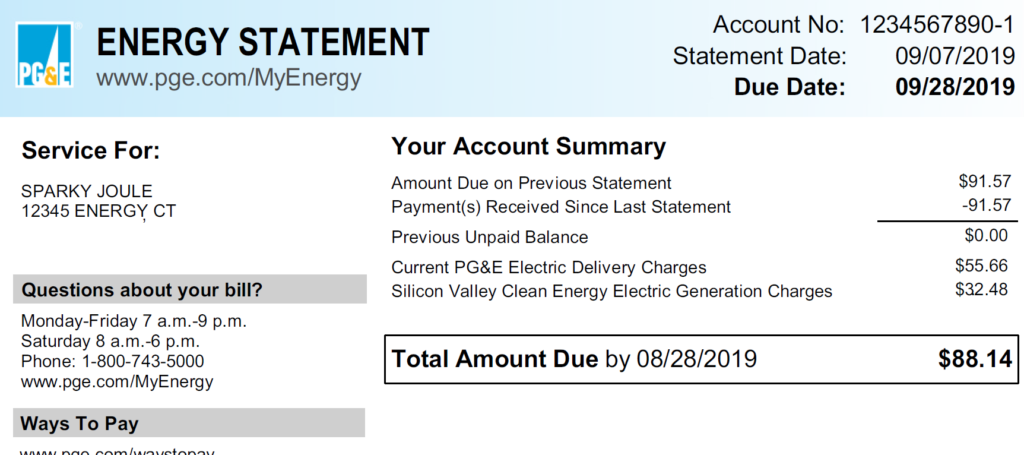

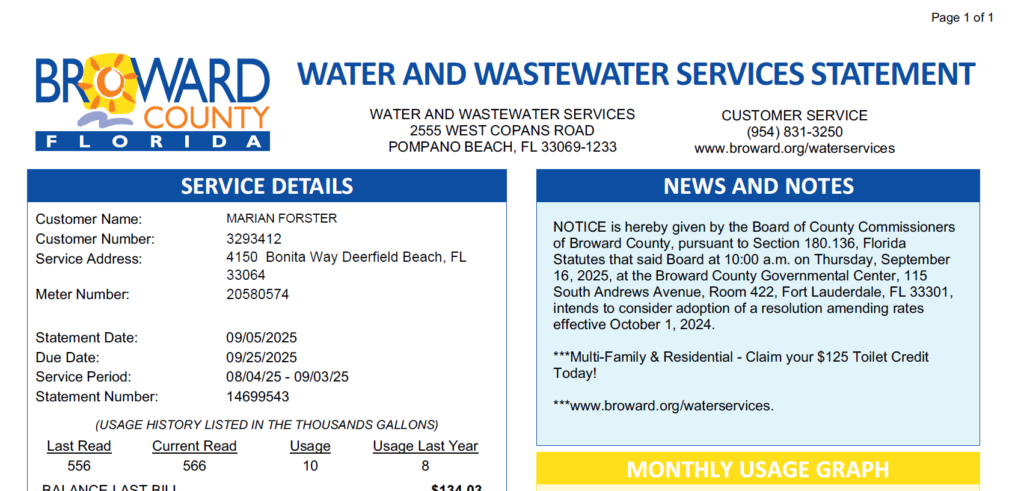

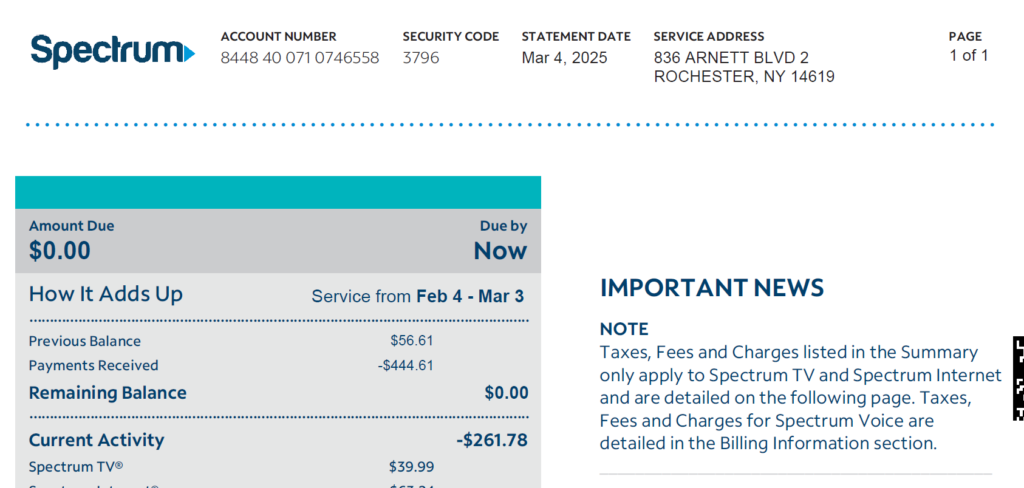

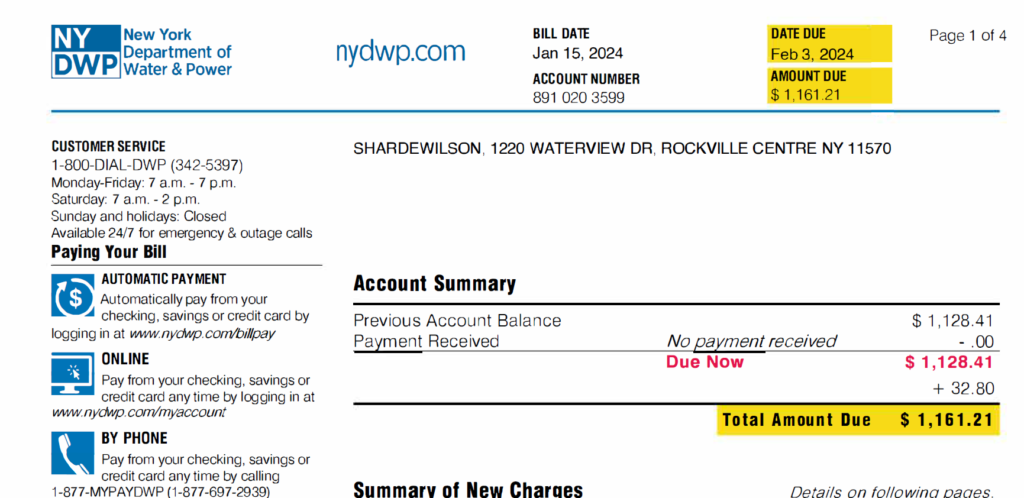

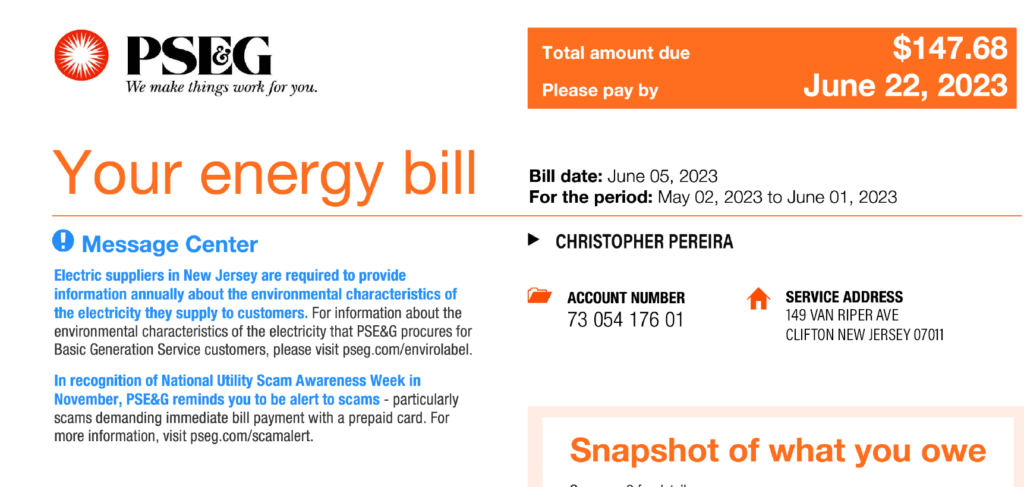

Other Documents

We also handle additional financial documents such as SSN cards, driver’s licenses, utility bills, and some other documents as well. All documents are organized in one place so nothing is missed when it matters most.